As a Chief Digital and Information Officer (CDIO) at UniCredit, my role is to spearhead the digital transformation journey, leveraging innovative technologies that bolster security and efficiency. One of the most exciting advancements in our technological arsenal is the Digital Twin technology – a concept that has matured from its initial association with IoT to become a standalone innovation, transforming how we understand and interact with our digital landscape.

Understanding Digital Twins

In the realms of manufacturing and product development, the concept of Digital Twins has been instrumental. However, it’s in the early 2000s that Dr. Micheal Grieves first conceptualized the term ‘Digital Twin’ to signify the digital replica of physical entities, fostering a harmonious human-machine interaction. This concept has been adapted in banking to create a synchronized virtual model that communicates with its physical counterpart, allowing for unparalleled real-time data analysis and system optimization.

The Core of Digital Twin Technologies

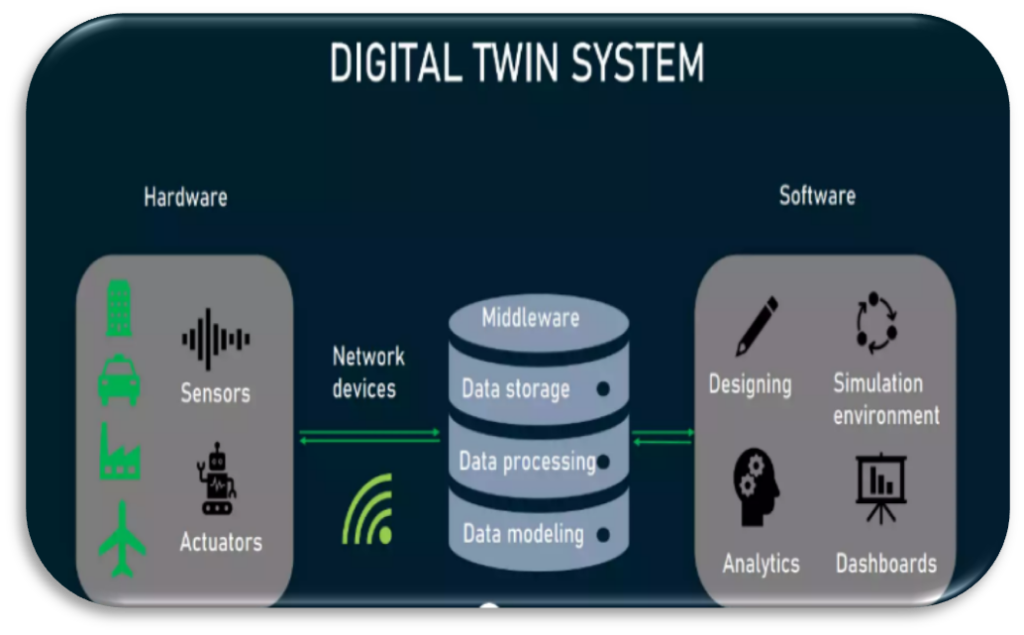

Digital Twin technology is built upon a tri-layered architecture:

-

- Hardware Layer: This includes the tangible components—sensors, IoT devices, actuators, servers—collecting real-time data.

-

- Middleware Layer: Acting as the central nervous system, this layer processes, stores, and models data, enabling data governance and connectivity.

-

- Software Layer: It creates the simulated environment, leveraging analytical engines and machine learning models for predictive analytics.

Threads of digital twins. Adopted from Alexsoft.com

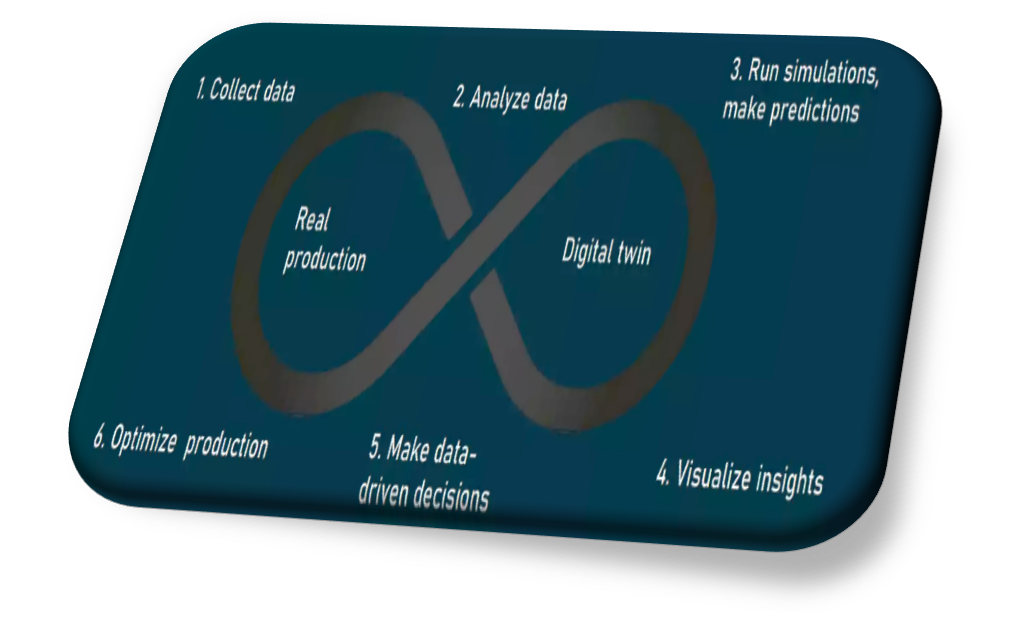

These components interact in a six-step, closed-loop system where data collection leads to analysis, prediction, visualization, decision-making, and optimization in a continual feedback loop.

Threads of digital twins. Adopted from Alexsoft.com

Digital Twins in the Banking Industry

For banks like UniCredit, the application of Digital Twins is a game-changer. It promises enhanced operational efficiency, risk management, compliance adherence, and a fortified cybersecurity landscape.

Case Study: Cybersecurity Threat Mitigation at Caixa Bank

A prime example of Digital Twin technology at work is within the cybersecurity infrastructure at Caixa Bank. Here, Digital Twins mirror network operations to anticipate and respond to cyber threats in real-time. This implementation can be broken down as follows:

- Data Collection: APIs and loggers gather network data, which is funneled to the data manager.

- Data Governance: Unified formatting and compliance checks are conducted before passing the data to the next stage.

- Threat Detection: Anomaly detectors, threat analyzers, and AI/ML modelers identify potential risks based on up-to-date threat definitions.

- Response Activation: Real-time metrics and alerts prompt immediate reporting and compliance actions.

Benefits and Broader Implications

Implementing Digital Twin technology for cybersecurity at Caixa Bank has proven to be beneficial in several ways:

- Enhanced Security Posture: By providing a real-time mirror of the network, the system can predict and prevent attacks before they occur.

- Reduced Detection Time: Quick identification of threats translates to faster response and resolution times.

- Cost Efficiency: Predictive maintenance and threat prevention reduce the costs associated with cyber attacks.

- Improved Monitoring and Compliance: Continuous monitoring ensures that security protocols are up-to-date with regulatory standards.

Similarly, Dassault Systems utilizes Digital Twin technology to orchestrate complex production and workforce management across vast geographic regions, ensuring secure and optimized operations.

However, the benefits of Digital Twin technology in the banking sector go well beyond cybersecurity, touching on several critical aspects of banking operations. Here’s a broader perspective on its potential impact:

- Streamlined Operations: Digital Twins streamline banking operations by modeling and simulating processes to identify and rectify inefficiencies without risking live operational disruptions. This leads to faster services and higher customer satisfaction.

- Risk Management Enhancement: The technology allows banks to anticipate outcomes based on various financial scenarios, aiding in robust credit and liquidity risk assessments, and informed decision-making.

- Regulatory Compliance: Digital Twins can simulate regulatory frameworks to ensure banking processes remain compliant, adapting quickly to new regulations and avoiding costly penalties.

- Product Innovation: By simulating market conditions and customer behaviors, banks can innovate and test new products in a virtual setting, reducing the risks associated with product launches.

- Sustainable Practices: Banks can use Digital Twins to assess and manage the environmental impact of their operations, aligning investment decisions with sustainable practices.

- Customized Banking Experiences: Analysis of customer data through Digital Twins enables banks to offer personalized financial services, boosting customer loyalty.

- Crisis Preparedness: Simulating crisis scenarios helps banks prepare effective responses, ensuring business continuity and maintaining customer trust.

- Cost Efficiency: Predictive maintenance and process optimization minimize operational costs by preventing inefficiencies and equipment failures.

- Informed Strategic Decisions: Digital Twins offer detailed insights that guide strategic planning, from infrastructure investments to market expansion.

- Market Differentiation: Adopting Digital Twin technology positions banks as innovators, providing a competitive edge in the fast-evolving financial sector.

In conclusion, the broader benefits of Digital Twins in banking are multifaceted, touching on virtually every aspect of the industry. By harnessing this technology, banks can gain a 360-degree view of their operations, markets, and customers, enabling them to anticipate challenges and seize opportunities with unprecedented agility.

The Future of Digital Twins in Banking

The implementation of Digital Twins in banking security is just the tip of the iceberg. This technology holds the potential to revolutionize customer service, fraud detection, financial planning, and even environmental sustainability practices within the banking sector.

At UniCredit, we remain committed to embracing such transformative technologies, ensuring not only the security and efficiency of our operations but also enhancing the overall customer experience. The future is a seamless blend of physical and digital – and with Digital Twins, we are ready to bridge that gap.